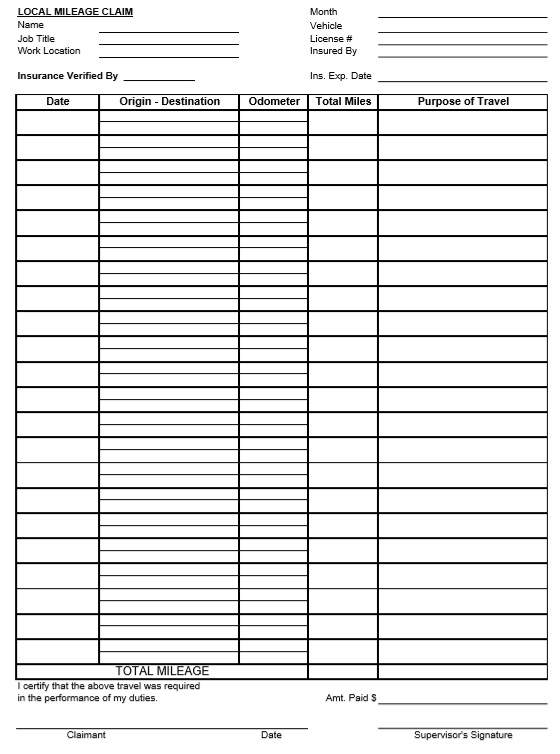

Download these 24 Free Sample Mileage Log Templates to help you prepare your own Mileage Log easily.

A Mileage Log is a personal document that you keep to enter the data of your personal and work related traveling. For personal use, you can just create a work sheet in Excel where you will put the date, purpose of traveling, duration, distance and other elements of the traveling. For work purposes, you can use a developed Application that will record all of your traveling details and you can view and update this sheet on your tablet, cell phone and personal laptop anywhere and anytime you want.

Contents

Importance of Mileage Log

When we talk about a Mileage Log, there are many benefits to discuss. Besides always knowing how much you have driven your vehicle and when will be the right time for Engine Oil change or Maintenance and Service, there are advantages for tax payments, vehicle warranty check, making sure the vehicle has good fuel consumption and keeping the updated status of all of your vehicles either personal or commercial. Some of the important benefits of keeping a Mileage Log include:

- Keeping Mileage Log for Tax Purposes:

There are many advantages for keeping a Mileage Log but the most important benefit is that with keeping this log updated, you can claim tax deductions. Whether you work for some company or you are self employed, this log will help you make sure you don’t pay the taxes that you don’t owe. If you are self employed, you can present your Mileage Log to show your personal traveling and work related traveling and you can ask for tax deductions. If you are working for another person, with the same log, your boss can also claim tax deductions on your salary. - Keeping Mileage Log for vehicle service and maintenance:

It is very important that if you want to use a vehicle for long time and even if you want to maintain your vehicle, you don’t find time for it or you always change engine oil after due date, a proper Mileage Log will help you make sure your vehicle gets maintenance and service on time. With a digital log, you can set reminders or alarms or even if you enter dates and travelling distance manually in an Excel sheet, you can check frequently for upcoming maintenance and service dates. - Keeping eye on your employees (company drivers):

If you run your own business, you always worry about making sure your drivers and employees make deliveries on time and they don’t waste company time or resources. When you ask your drivers and employees to keep mileage log, you can just take a look at the mileage log and see how much your employees travel, and where they traveled and for what purpose they traveled. - Getting traveling incentives from your company:

In case you work for another company and you travel a lot for work purposes, your employer will allow you to claim travelling charges including the fuel, maintenance and hotel staying for out of town meetings. When you have kept a proper Mileage Log, you don’t need to give justification for any specific traveling but you can just present the log to your boss and ask him to take a look at it.

Free Mileage Log Templates

Here is preview of This First Sample Mileage Log Template in MS Word format.

Types of Mileage Logs

It’s essential for individuals and businesses that use vehicles for their operations and wish to stay on top of factors like cost, tax, and reimbursements, to have a mileage log ready at all times. How to utilize a mileage log varies with the requirements of the user, reason for the travel, and industry standards. It is crucial for businesses and individuals to grasp the various forms of the mileage log that will be useful to them in choosing the appropriate tracking tool.

Business Mileage Logs for Tax Deductions

Mileage logs are very useful for many reasons and especially for tax deductions. For instance, people who are self-employed or run a business and drive their own cars for business-related activities can get some deductions on fuel, service, and other costs related to the car. In such cases, a mileage log may be required detailing the travel date, the start and end odometer readings, distance travelled, place of visit, and the purpose of the trip. The IRS and other taxation agencies have strict documentation requirements for the deduction of mileage logs and for this reason, precision is important. Descriptions that are not adequate enough or are varied in any way will lead to the claim being dismissed or even fines instead.

Employee Mileage Reimbursement Logs

A large number of organizations compensate workers for work mission trips conducted using employees’ vehicles. A mileage log creates an accountability structure for travel so that employees can be compensated justly at company or governmental mileage rates. Employers need precise and complete logs that confirm expenditures before they approve reimbursements. Some of the organizations rely on paper logs, others have adopted systems for mileage tracking using apps that automatically capture distances covered and prepare reports that are used when processing employees’ compensations. A well-maintained mileage log assists in avoiding contentions and helps in adhering to the aspects of travel policy.

Fleet and Company Vehicle Logs

Mileage logs are necessary for businesses that run a fleet of company cars and track vehicle mileage, which is useful for optimizing utilization and fuel consumption as well as keeping up with vehicle maintenance. These logs help reduce operational costs and facilitate businesses in managing the utilization of any vehicles and operating under company policies related to such vehicles. It is also possible to detect when employees use too much fuel or take trips that are not authorized or perhaps do not follow the routes very well and this is where fleet managers come in. The assets can also be managed well by taking into account depreciation, how much the company is expending if they have leased out vehicles and maintaining the vehicles in order to improve their useful life.

Personal Mileage Tracking for Expense Management

Those who have to move from one place to another for work or other purposes may rely on mileage logs to keep track of vehicle costs, whether personal or business, to manage expenses. With a mileage log, it becomes possible to evaluate the amount of fuel used, service costs, and travel costs. This is particularly necessary for drivers for ride-hauling and ride-sharing services along with delivery workers and so forth who benefit from having trackable mileage records to support costs incurred and taxes paid.

Understanding the different mileage log types helps both individuals and corporations with effective tracking processes so that they can reap maximum rewards financially, observe the requirements, as well as maintain proper vehicle utilization records.

Benefits of Using Mileage Logs

A mileage log is crucial for individuals as well as organizations who need to keep track of their vehicles for taxation purposes, reimbursement or reporting of business expenses. A vehicle mileage log provides documentation necessary for taxation purposes and financial records effectively and correctly for maximum deductions. It also prevents destruction of the discipline of work, distortion of the records, and derates fraud. Occurrence of such events shall be completely eliminated through mileage recording techniques.

Maintaining Accurate and Consistent Records

One of the most practical aspects of maintaining a mileage log involves use of focus on accuracy and for that consistency. Focusing on how every single trip made is logged is crucial to eliminate any mistakes and ommissions. This is because if at any point the details are entered late, the mileage may be distorted thereby leading to inaccurate claims. Every single log has to cover the date of the trip, the beginning and closing odometer readings for the trip, the number of miles and the reason and place of the travel. This format is very standard and helpful as it keeps a good record and also resolves queries on mileage during an audit. The traditional method can also be replaced by digital mileage apps that perform equal and less prone to errors.

Differentiating Personal and Business Mileage

The separation of business travel from personal travel is an important factor as far as tax compliance and company policies are concerned. Since the IRS, as well as local tax agencies, bind mileage tax claims to the documentation of business mileage, any personal use risks such claims being disallowed or even attracts punishment. The company should set up reimbursable conditions and include them in a policy document in order for employees to easily adhere to the correct mileage log policy. This also ensures that no personal miles get included in the mileage reported for taxes or even for reimbursement as two distinct records are kept for each mileage log mileage.

Using Technology for Efficiency

Trying to fill a mileage log manually can be tasking and one can make many mistakes. Switching to mileage tracking applications based on GPS hardware, or systems which log mileage automatically enhances the effectiveness and reduces the chances of making errors. As real time mileage is recorded and trip details entered, it also generates forms to account for mileage deduction or to substantiate reimbursed expenses. The application allows classifying trips into work or personal hence no need to compute by hand. Any company with mile reimbursement for its employees should promote the use of this technology in order to ensure uniformity across all records and that they can be cross checked.

Keeping Mileage Logs for Audit Compliance

The tax agencies require that all commercial enterprises, as well as all individuals, must retain mileage log for a span of several years in order to validate any adopted deductions. On this note, it is advisable to maintain the records generally in an organized and shed plausible maintenance so that the claimant organizes verifiable mileage if requested. The logs to either digital or paper form and should be available in case adversities include loss. This Mileage log does not protect the user financially alone as there are no held liabilities from conflicting mileage compensation and meeting the relevant legislation as well as taxation expectations.

By following these best practices, individuals and businesses can maximize tax benefits, ensure accurate reimbursements, and maintain a transparent record of vehicle usage.

File Type: MS Word {ZIP File}

File Type: MS Word {ZIP File} File Type: MS Word {ZIP File}

File Type: MS Word {ZIP File} File Type: MS Word {ZIP File}

File Type: MS Word {ZIP File} File Type: MS Excel {ZIP File}

File Type: MS Excel {ZIP File} File Type: PDF Format {ZIP File}

File Type: PDF Format {ZIP File} File Type: PDF Format {ZIP File}

File Type: PDF Format {ZIP File} File Type: PDF Format {ZIP File}

File Type: PDF Format {ZIP File} File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word File Type: MS Word

File Type: MS Word